Sacrifices made for the cost-of-living crisis

We’re pleased to bring you the latest update to the Health, Wealth & Happiness Report, and an update to our Health, Wealth & Happiness Index, which you can read in more depth on our report index page.There’s a lot going on in the world but this edition focuses on the cost-of-living crisis and the extent to which it’s dominating our thoughts, decisions, mental health, spending and actions.

This is what we’re cutting out and giving up. And what we refuse to give up. Here you’ll find scenarios that now look uncomfortably likely, and you’ll see what big life decisions many of us are having to put on pause.

This year's report also reveals how high up the chain the crisis goes. Cost-cutting and sacrifice are reality not just for younger and average income families but for older age categories and high earners too. There’s not a lot of sunny reading inside, we can only hope and wish for better news soon.

Cutting down costs, day to day

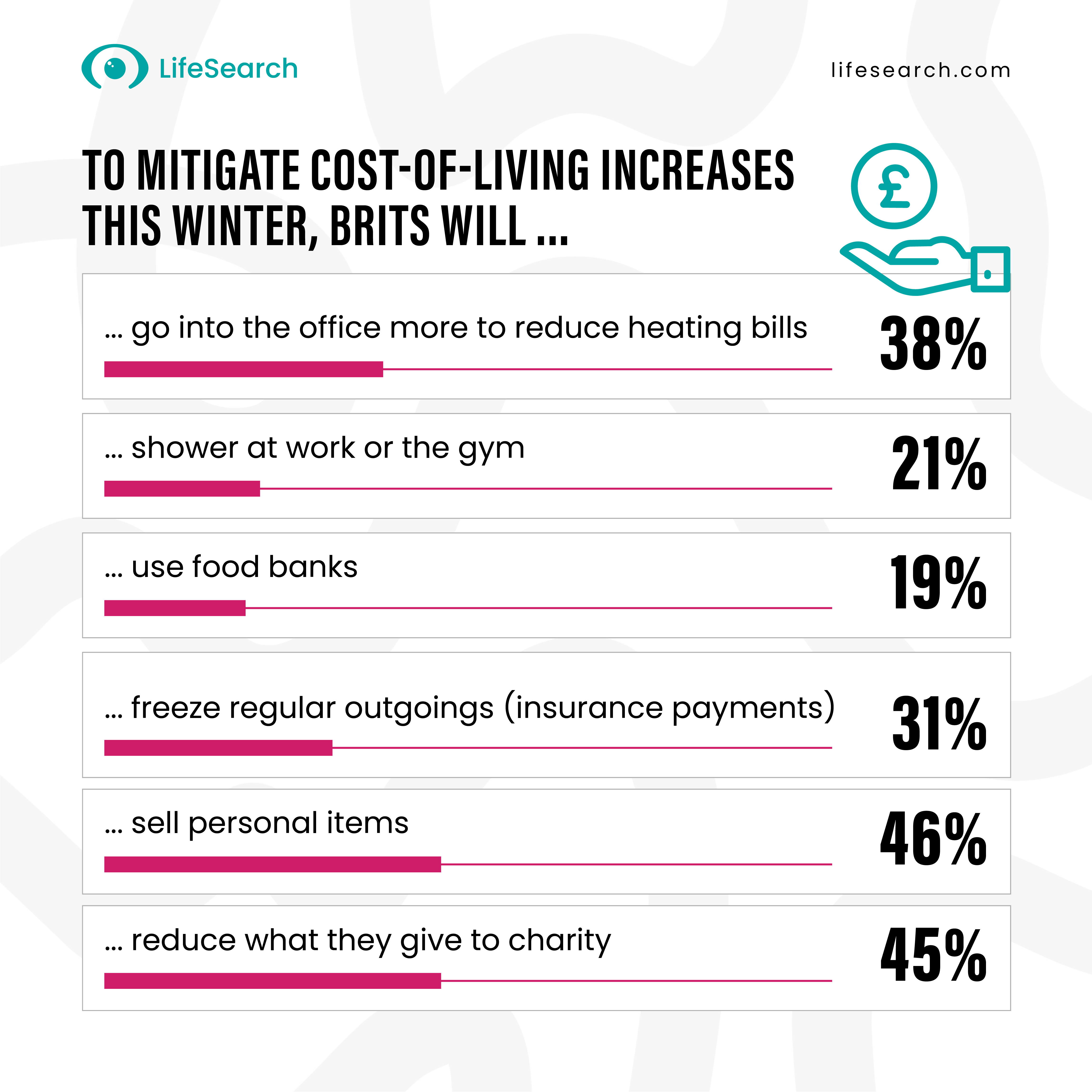

Brits set to shower at work, let out rooms and sell possessions to get by.

Life dreams are being delayed

Kids, houses, businesses - crisis forcing Brits to put life goals on pause.

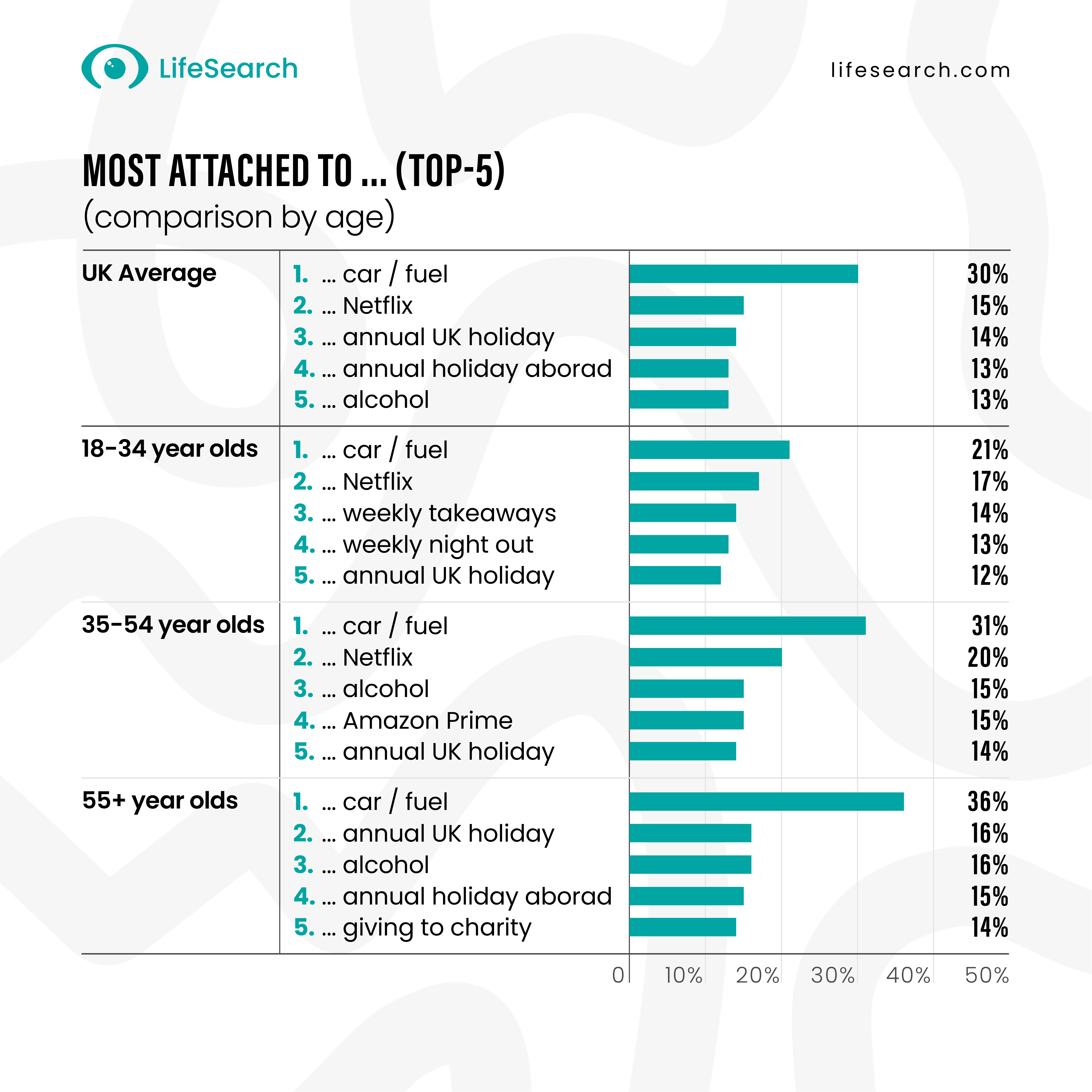

What are Britain's untouchables?

I'll give up this but I WON'T give up that. Things Brits aren't prepared to give up.

What's denting mental health?

Millions of Brits say that the cost-of-living crisis is constantly front-of-mind.

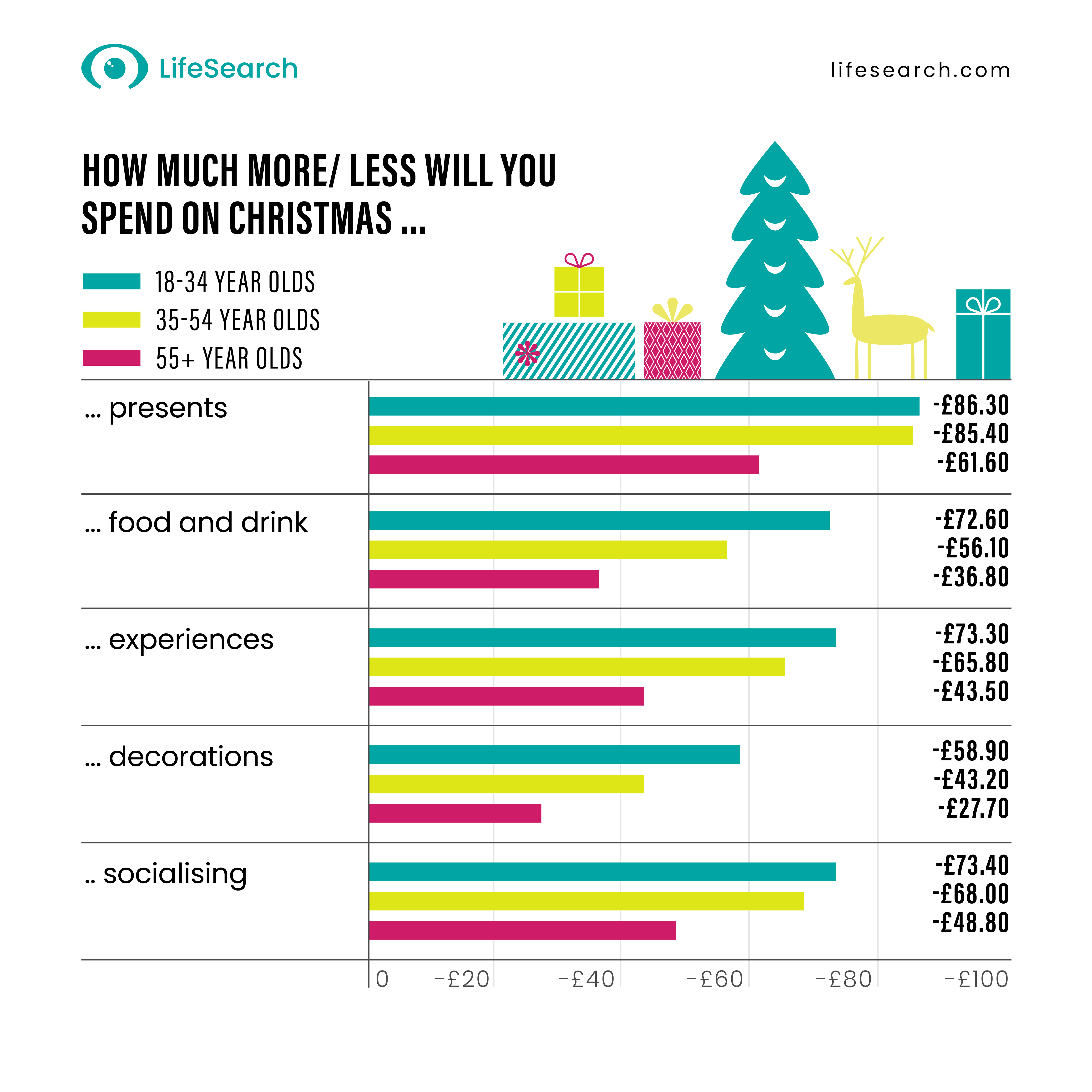

A tight Christmas is on the way

Brits to spend hundreds of pounds less on presents, food & events this Xmas.

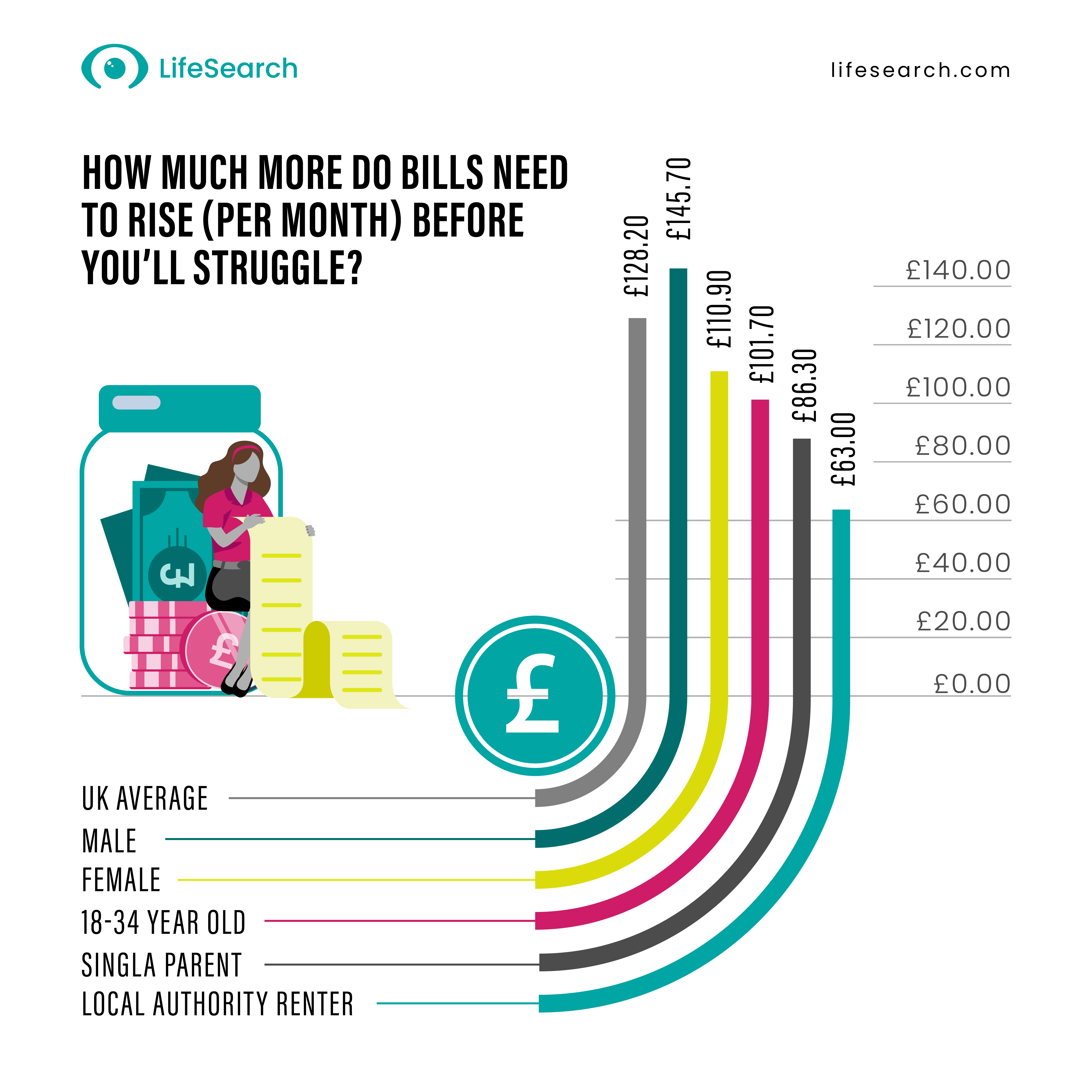

£128-Brits financial tipping point

How much more do Britain's bills have to rise for households to struggle?

2022 Health, Wealth & Happiness Report headlines

Click the buttons for a snapshot of the headlines in health, wealth and happiness. See how brits tackle cost-cutting, and what to expect this Christmas.

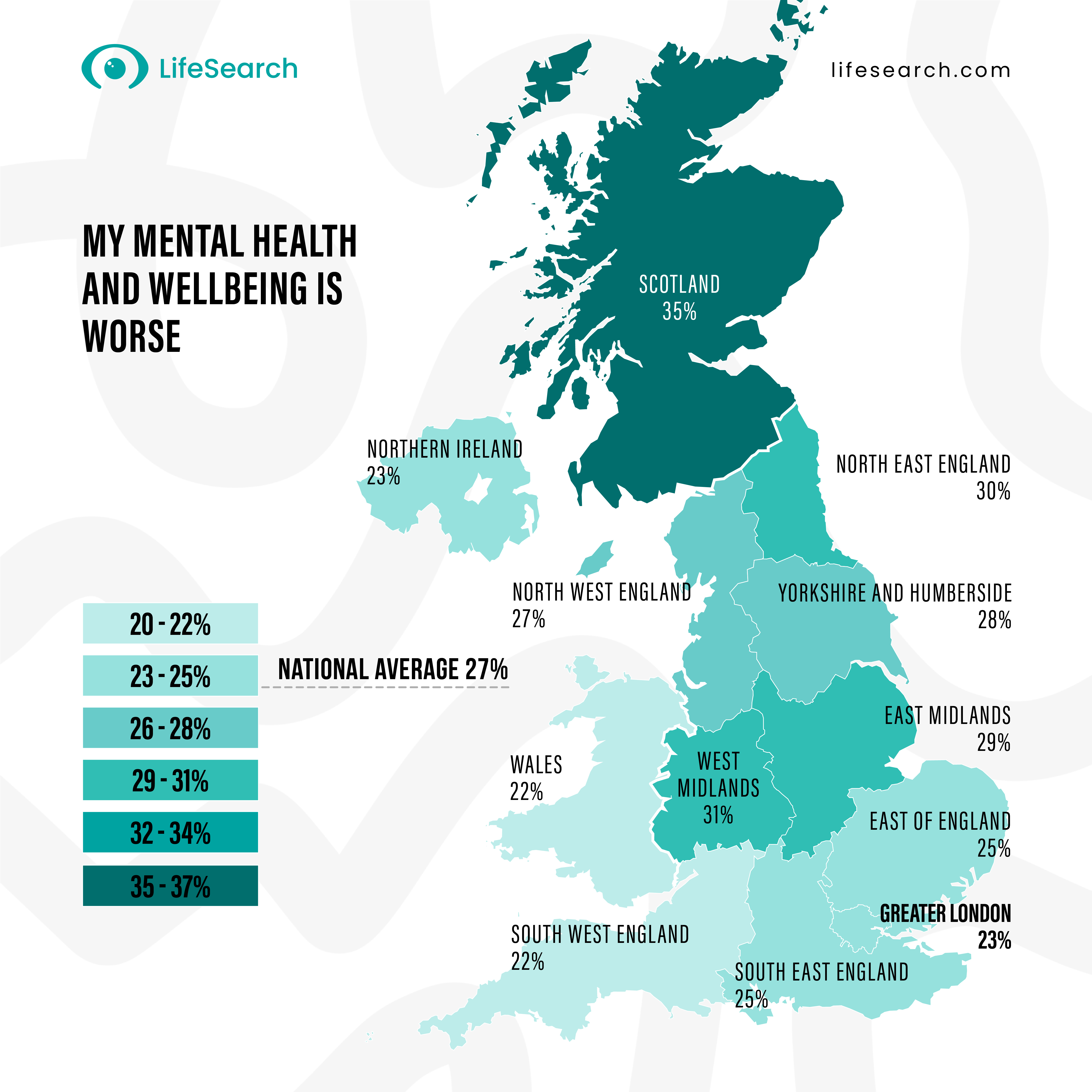

Mental health has suffered in the last six months, with wellbeing in Scotland diving far below the average. The top three reasons people give to explain their decline in mental health all relate to the cost-of-living crisis.

We asked survey respondents how much more do bills have to rise before things become a struggle. Soberingly, a lot of people have already reached that point. For some of those who haven’t just £100 or even £60 more will tip the scales.

Brits are adopting a range of cost-saving behaviours to ease pressure and make ends meet through the rest of 2022 and into next year, including working more from the office, showering at the gym, car-pooling, changing supermarkets and turning to more efficient home heating options.

We look in this report at the budget items Brits are cutting, but there’s also a list of uncuttables which includes using the car, Netflix, alcohol, holidays and more. There’s also a gender stereotype or two in there with some females refusing to give up the hairdresser and some males sticking to their sport TV subscription.

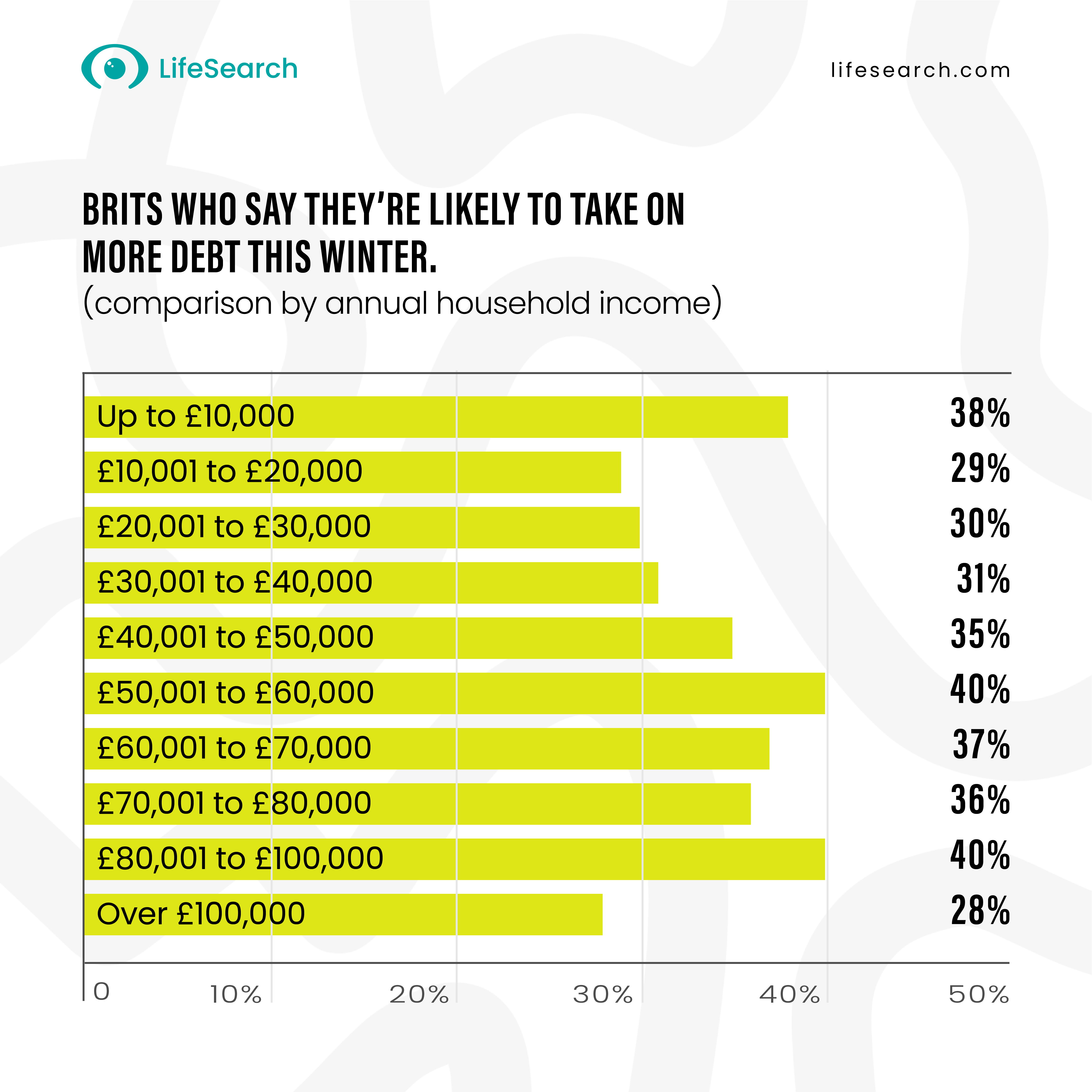

A large portion of Brits believe they’ll get into debt over the next few months, but what’s revealing is that higher earners are just as likely (and in some cases more likely) to see debt in their future than lower-earning households.

Brits are set to spend several hundred pounds less on Christmas presents, parties, food and drink this year. While any major belt-tightening usually hits younger people hardest, the 35-54-year-olds are cutting Christmas costs at a similar ratio. And predictably, it's parents who are hit hardest of all.

Read the previous Health, Wealth & Happiness reports

2017 | 2018 | 2019 | 2020/2021 Q1 | May 2022